5 minutes read

Shaping Your Key Account Management (KAM) Strategy using Environmental, Social, and Governance (ESG) in the European MedTech Sector

The European medical technology (MedTech) landscape is undergoing a significant shift. ESG factors are no longer just buzzwords; they’re rapidly becoming essential considerations for key account management (KAM) strategies. Hospitals, healthcare providers, and other key accounts are increasingly prioritising partnerships with MedTech companies that demonstrate strong ESG performance.

A growing number of European healthcare institutions are embedding ESG criteria into their procurement decisions. A Bain & Company survey reveals that 82% of German healthcare procurement decision-makers expect ESG to become even more important in the next five years.

Vamstar’s recent study on the usage of ESG criteria in MedTech tenders across Europe highlighted the increase in usage of mandatory and value-adding criteria across Europe. One of the observations was inherent inconsistencies in objectives, criteria, and language.

The swift integration and diversification of ESG clauses by buyers present a formidable challenge in assessing associated risks. The lack of uniformity in criteria and language employed by various buyers, even within a single province, poses a significant hurdle for suppliers. Buyers exhibit diverse focal points concerning E, S and G aspects, as well as product domains dictated by their consumption patterns and local regulatory frameworks. This divergence results in a lack of standardisation in criteria among buyers, thereby complicating the evaluation process.

Organisations exhibit substantial diversity in their objectives, each emphasising distinct focus areas such as carbon footprint reduction, waste management, product durability, social inclusivity, combatting child labour, and safeguarding data privacy. Furthermore, there exists a notable deficiency in buyers’ comprehension regarding the methods to ensure adherence to ESG criteria. Consequently, suppliers encounter challenges in providing requisite information consistently due to the varied formats and structures sought by buyers.

The exponential surge in the utilisation of ESG criteria, particularly those pertaining to environmental concerns, across countries, has escalated the risk of revenue loss. This trend is anticipated to persist and intensify until 2026, particularly across Europe.

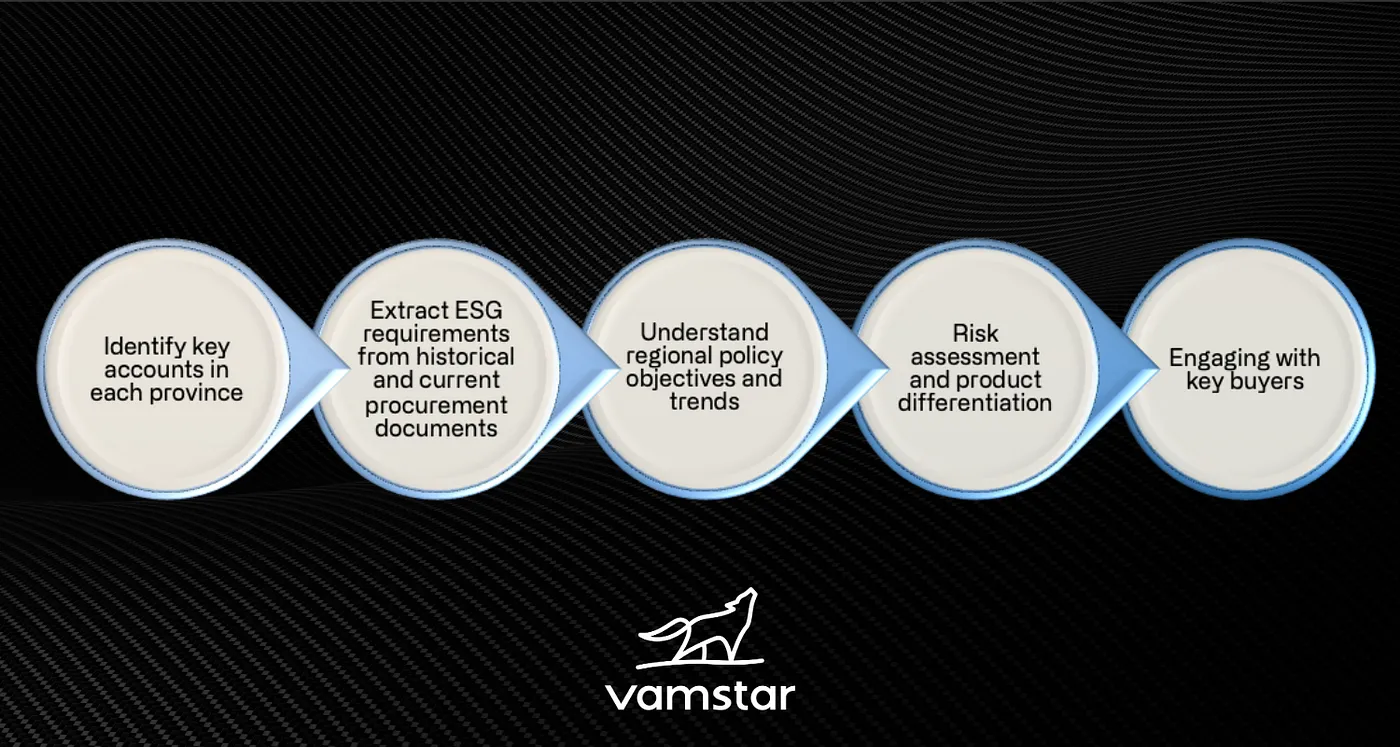

The utilisation of criteria, language, and requisites varies not only across countries or regions but also among individual buyers. Consequently, there arises a necessity for tracking intelligence pertinent to all key accounts in order to discern prevailing trends.

Suppliers must align their key account management with ESG requirements to enhance risk management and cultivate a product differentiation strategy. Given that in most markets, a small number of key accounts contribute significantly to revenue generation, any alteration in ESG policy poses both risks and opportunities. An ESG tracker emerges as imperative, furnishing granular insights into evolving purchasing prerequisites.

In the MedTech sector, where innovation intersects with human health and well-being, ESG considerations hold profound significance. Integrating ESG into Key Account Management Strategies would result in the following advantages:

1. Building Trust and Credibility: Incorporating ESG principles into KAM strategies fosters trust and credibility with key accounts. Aligning buyer’s ESG objectives with the This resonates well with key stakeholders, including healthcare providers, institutions, and regulatory bodies.

2. Risk Mitigation and Compliance: ESG integration in KAM strategies enables companies to identify and mitigate potential risks more effectively. By proactively addressing environmental risks, such as pollution or resource depletion, companies can avoid regulatory fines and reputational damage.

3. Driving Innovation and Differentiation: Embracing ESG considerations within KAM strategies stimulates innovation and differentiation within the MedTech sector.

4. Enhancing Long-Term Relationships: Successful KAM strategies are built on long-term, mutually beneficial relationships with key accounts. By integrating ESG principles into these relationships, companies can deepen engagement and foster loyalty among key stakeholders.

5. Cost Reduction: Sustainable practices can lead to cost savings through reduced waste, energy efficiency, and responsible sourcing.

Conclusion

In the dynamic European MedTech landscape, integrating ESG into your KAM strategy is no longer optional. It’s a strategic imperative for building long-term, sustainable partnerships with key accounts. By understanding your key accounts’ priorities, aligning your efforts with their needs, and building a data-driven ESG narrative, MedTech companies can solidify their position in a rapidly evolving market.

Other Materials

Book a 30 minutes meeting with us

Welcome to our scheduling page! Please choose an available date below to get started.

30 minutes meeting

We’ll email you the meeting link